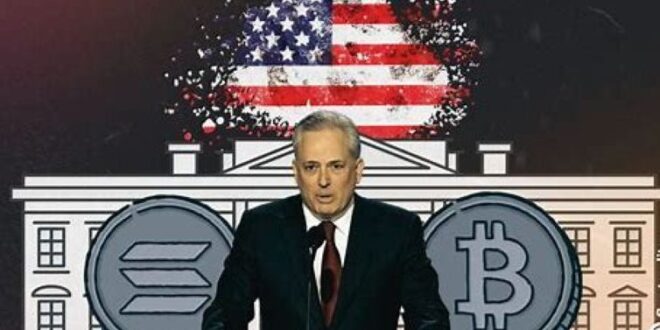

Prominent tech investor and crypto advocate David Sacks has launched a scathing critique of the U.S. federal government’s handling of Bitcoin, accusing policymakers of mismanagement, regulatory overreach, and missed opportunities. His remarks highlight ongoing tensions between the crypto industry and Washington, particularly regarding seized BTC auctions, unclear regulations, and the government’s broader stance on digital assets.

Is Sacks right? Has the federal government mishandled Bitcoin, and what are the consequences for investors and the market?

The Federal Government’s Track Record on Bitcoin

Sacks’ criticism stems from several key areas where he believes the government has failed to effectively manage Bitcoin:

1. Selling Seized Bitcoin Too Early

The U.S. government has historically auctioned off large amounts of seized BTC—often at prices far below today’s market value. Examples include:

- 2014: The government sold 30,000 BTC seized from the Silk Road at around $600 per Bitcoin (worth over $2 billion today).

- Multiple auctions since then have seen similar sales, often raising questions about why the government offloads BTC rather than holding it as a strategic asset.

Sacks argues that this approach represents shortsighted financial management, especially as nations like El Salvador are actively accumulating Bitcoin as a reserve asset.

2. Regulatory Uncertainty Stifling Innovation

Sacks also slammed the federal government for creating an unclear and hostile regulatory environment for Bitcoin and crypto firms. Key concerns include:

- The SEC’s aggressive crackdown on crypto firms, often using outdated securities laws.

- Lack of clear guidelines for Bitcoin ETFs and institutional adoption.

- Operation Choke Point 2.0? – Many in the crypto industry believe the government is pressuring banks to cut ties with crypto businesses, limiting innovation and growth.

3. Potential Strategic Mistakes in the Global Crypto Race

Sacks warns that by failing to properly embrace Bitcoin, the U.S. risks falling behind in the global financial arms race. Other countries are moving ahead:

- El Salvador made Bitcoin legal tender and continues to accumulate BTC on its balance sheet.

- China, despite banning Bitcoin mining, is developing a digital yuan as a competitor to crypto and the U.S. dollar.

- UAE and Hong Kong are crafting pro-crypto regulatory frameworks to attract investment.

Sacks argues that instead of offloading Bitcoin, the U.S. should consider strategically holding BTC as a hedge against economic instability and a potential future reserve asset.

Market Reaction and Future Implications

Sacks’ comments resonate with many in the crypto community who have long accused the government of mismanaging digital assets. If policymakers continue down this path, we could see:

- More capital and innovation flowing to crypto-friendly jurisdictions.

- Continued uncertainty for Bitcoin’s regulatory status in the U.S..

- Potential government policy shifts if public and institutional pressure increases.

David Sacks’ fiery critique underscores a growing debate over how governments should manage, regulate, and strategically position themselves with Bitcoin. While Washington continues its cautious approach, Sacks and others warn that failing to adapt could mean missing out on one of the most significant financial revolutions of our time.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News