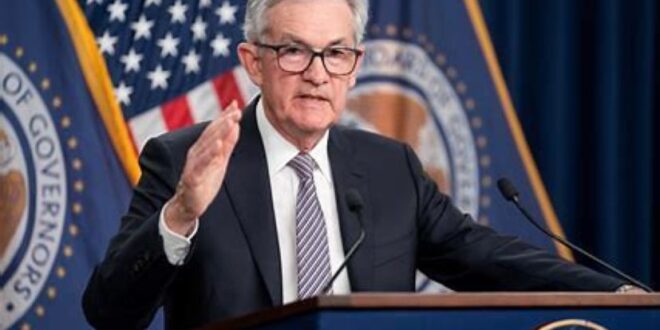

As investors eagerly anticipate the Federal Reserve’s next moves, economist Timothy Peterson has issued a stark warning: delaying interest rate cuts could trigger a significant market downturn. With inflation cooling and economic growth showing signs of strain, Peterson cautions that postponing monetary easing could push equities into a correction and weaken investor confidence.

The Risks of Holding Rates Higher for Longer

The Federal Reserve has maintained a cautious stance on rate cuts, emphasizing the need for sustained inflation control before loosening monetary policy. However, Peterson argues that waiting too long could have unintended consequences, particularly for financial markets that have been pricing in rate reductions for months.

Higher interest rates increase borrowing costs for businesses and consumers, slowing economic activity. If rates remain elevated for too long, Peterson warns, it could lead to tighter credit conditions, reduced corporate earnings, and a contraction in stock valuations. “Markets thrive on expectations, and if the Fed disappoints, we could see a sharp pullback in risk assets,” he explained.

Market Volatility and Investor Sentiment

Investors have been on edge as conflicting economic data creates uncertainty about the Fed’s next move. While inflation has moderated, concerns over employment trends and sluggish GDP growth have raised alarms about potential stagflation—where inflation remains persistent despite slowing economic activity.

Peterson highlights that a delayed response from the central bank could amplify market volatility, particularly in equities and risk-sensitive assets like cryptocurrencies. “We’ve seen this play out before—if the Fed waits too long, the market corrects violently,” he noted.

Potential Recessionary Pressures

Beyond market volatility, Peterson warns that delaying rate cuts could increase the risk of an economic slowdown. Historically, prolonged periods of high interest rates have preceded recessions as businesses cut back on investment and consumers reduce spending. If economic growth stalls, the Fed may be forced to cut rates more aggressively later, potentially causing further instability.

Several analysts share Peterson’s concerns, noting that yield curve inversions—often a precursor to recessions—remain a worrying signal. “The Fed risks tightening too much and then having to reverse course rapidly, which can create even greater market disruptions,” Peterson added.

What Comes Next?

The Federal Reserve’s next policy meeting will be closely watched for signals on its rate trajectory. While some officials have hinted at potential cuts later in the year, stronger-than-expected economic data could push those plans further out.

If Peterson’s warning holds true, a prolonged delay in rate reductions could create ripple effects across asset classes, from stocks and bonds to cryptocurrencies and commodities. Investors will need to brace for heightened volatility and potential downside risks as the Fed navigates its delicate balancing act between inflation control and economic stability.

Timothy Peterson’s warning serves as a critical reminder of the delicate relationship between monetary policy and market stability. With investors hoping for rate relief, any misstep by the Fed could have far-reaching consequences. Whether the central bank acts in time or risks triggering a downturn remains the key question in the months ahead.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News