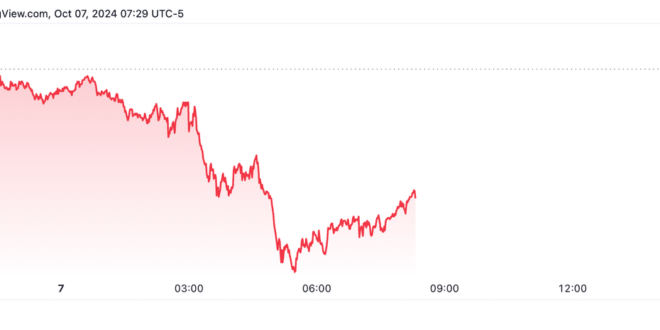

Futures for the S&P 500 (ES=F), Nasdaq (NQ=F), and Dow Jones Industrial Average (YM=F) all trended lower on Monday morning.

This decline came as the 10-year Treasury yield (^TNX) hovered near a 7-month high of 4.6%.

Stocks ended last week on a negative note, with significant drops in major tech names like Tesla (TSLA) and Nvidia (NVDA). The Nasdaq Composite dropped by 1.5%, while the S&P 500 lost over 1%.

The much-anticipated “Santa Claus” rally, which historically has been one of the most consistent seven-day positive stretches for the S&P 500, has failed to materialize this year. Since 1950, the S&P 500 has typically gained 1.3% during the seven trading days beginning Dec. 24, significantly outpacing the average seven-day gain of 0.3%, according to LPL Financial’s chief technical strategist Adam Turnquist. However, in this period, the S&P 500 is down by less than 0.1%.

With just two days of trading left in 2024, investors are hoping to end the year on a high note, reflecting the gains that have characterized the broader market this year. The S&P 500 is up more than 25%, while the Nasdaq has gained over 30%. The Dow has risen a more modest 14%.

In other news, former President Jimmy Carter passed away at the age of 100 at his home in Plains, Georgia, according to the Carter Center. Despite the news, equity markets are still set to open at 9:30 a.m. ET on Monday.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News