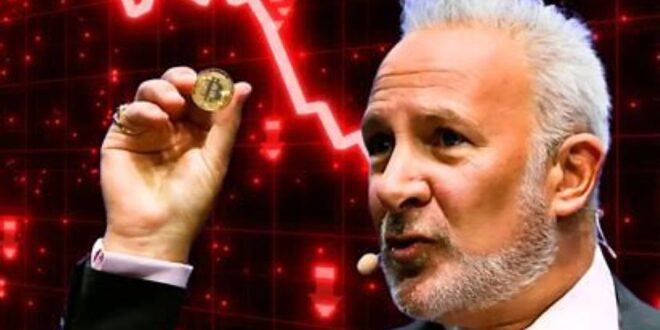

Renowned gold advocate and Bitcoin critic Peter Schiff has issued a fresh warning, predicting that Bitcoin (BTC) could drop below $65,000 if the Nasdaq experiences a significant downturn. Schiff, known for his skepticism toward crypto, argues that Bitcoin remains highly correlated with tech stocks and is vulnerable to broader market weakness.

Schiff’s Bitcoin-Nasdaq Correlation Argument

In a recent social media post, Schiff pointed out that Bitcoin’s price movements closely mirror those of the Nasdaq Composite Index, which tracks many of the world’s largest technology companies. He believes that if a major sell-off occurs in tech stocks, investors may dump Bitcoin alongside traditional risk assets.

“Bitcoin is not a hedge against stock market declines—it’s just another speculative asset. If the Nasdaq falls sharply, Bitcoin will follow,” Schiff warned.

While many crypto proponents argue that Bitcoin is a decentralized store of value, Schiff maintains that it behaves more like a risk-on asset, similar to high-growth tech stocks that tend to decline in times of economic uncertainty.

Is Bitcoin’s Recent Rally at Risk?

Bitcoin has seen strong bullish momentum in 2024, fueled by institutional demand, ETF approvals, and halving anticipation. However, Schiff believes this optimism could be short-lived if macroeconomic conditions shift.

Key risk factors he highlights include:

🔻 Interest Rate Policies – A shift in Federal Reserve policy could trigger a stock market correction, dragging Bitcoin down.

🔻 Economic Recession – If the economy weakens, investors may exit speculative assets in favor of cash or safe-haven investments.

🔻 Tech Stock Sell-Offs – A decline in major Nasdaq-listed firms could spill over into crypto markets, forcing liquidations.

Counterarguments: Is Bitcoin More Resilient Now?

Many crypto analysts dispute Schiff’s view, arguing that Bitcoin’s institutional adoption and growing role as digital gold make it less vulnerable to stock market downturns. They point to:

✅ Bitcoin ETFs driving new investment flows.

✅ On-chain data showing long-term holders accumulating.

✅ Decreasing correlation between Bitcoin and equities over time.

However, historical data does suggest that Bitcoin has often declined alongside equities during market downturns, leaving traders on high alert.

What’s Next for Bitcoin?

As markets brace for potential volatility, all eyes will be on the Federal Reserve’s policy decisions, stock market trends, and Bitcoin’s ability to hold key support levels. If Schiff’s prediction holds true and the Nasdaq crashes, Bitcoin’s path toward new all-time highs could face serious hurdles.

Schiff remains one of Bitcoin’s loudest critics, but his warnings about market correlations and economic headwinds are worth considering. Whether Bitcoin can break away from traditional finance trends remains a key question for investors moving forward.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News