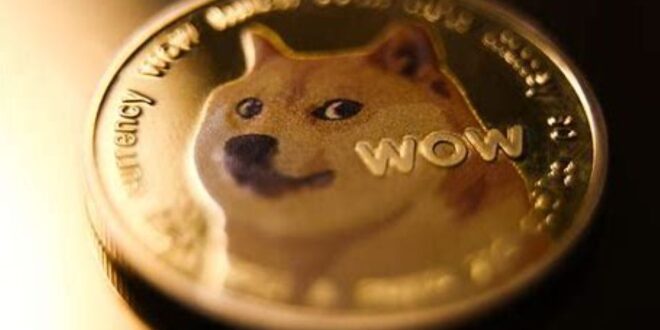

Dogecoin, the internet’s favorite meme coin, just got a major dose of institutional credibility.

21Shares, a leading crypto asset manager, has officially launched the world’s first Dogecoin exchange-traded product (ETP) on Switzerland’s SIX Swiss Exchange, bringing the Shiba Inu-themed token to the heart of Europe’s financial markets.

Traded under the ticker DOGE, the new ETP allows investors to gain exposure to Dogecoin without having to directly hold or manage the cryptocurrency themselves—an appealing option for traditional investors looking to dip a paw into the crypto space.

“This launch is a nod to the growing demand for diversified crypto products and the unique place Dogecoin holds in the market,” said Hany Rashwan, CEO of 21Shares. “It’s not just a meme anymore—Dogecoin has real liquidity, a massive community, and a surprising resilience.”

Originally created as a joke in 2013, Dogecoin has evolved into a serious player in the digital asset world, bolstered by celebrity endorsements, viral appeal, and a loyal fanbase. It has maintained its position among the top 10 cryptocurrencies by market cap for much of the past few years.

The DOGE ETP is fully collateralized, meaning each unit is backed by real Dogecoin held in cold storage, and it offers a regulated and secure route for investors to gain exposure without the technical hurdles of managing crypto wallets.

Analysts say this move reflects a broader trend: the maturation of meme coins into legitimate financial instruments. “This isn’t just a novelty—it’s about meeting investor demand where it is,” said Lara Schmid, a Zurich-based crypto analyst. “ETPs like this can help bring mainstream legitimacy to previously overlooked assets.”

Dogecoin may have started as a meme, but with 21Shares’ latest product, it’s clear: the joke’s on anyone still doubting its staying power.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News