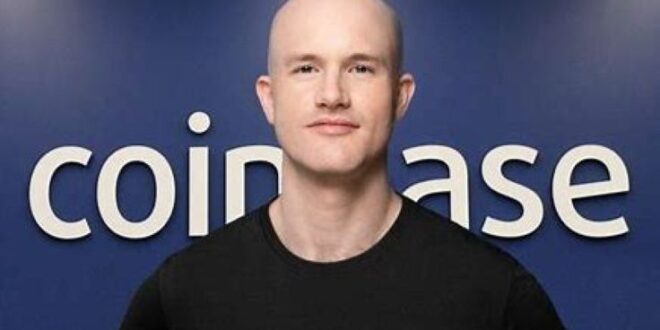

The cryptocurrency world has been buzzing ever since Donald Trump made his latest push for a pro-crypto agenda in the United States. Now, Coinbase CEO Brian Armstrong has weighed in on the former president’s plans, stating that they could have a profound impact not only on the crypto space but also on the broader finance and technology sectors. Armstrong’s remarks have sparked discussions across industries, highlighting the intersection of politics and emerging digital finance technologies.

Trump’s Crypto Plans: A Bold Vision for the Future

Trump’s growing support for cryptocurrencies marks a sharp turn from the earlier skepticism and regulatory battles that marked his presidency. While Trump has previously expressed concerns over Bitcoin as a competitor to the U.S. dollar, his latest statements suggest he sees the potential for digital assets to thrive in the U.S. economy. The former president has endorsed blockchain technology and crypto innovation as integral parts of America’s financial future, backing policies that support market-driven growth and a competitive edge in the global digital asset race.

Trump’s pro-crypto stance includes proposals to ease regulations around digital currencies, clarify tax implications for crypto businesses, and ensure that the U.S. remains a leader in the decentralized finance revolution. He has argued that the blockchain technology underlying cryptocurrencies offers significant benefits for transparency and efficiency in financial systems, positioning digital assets as a vital tool for both economic growth and national security.

Coinbase’s Response: Positive Outlook for Crypto Innovation

As one of the largest and most influential players in the crypto exchange space, Coinbase’s CEO, Brian Armstrong, has long been an advocate for clearer regulatory frameworks that support innovation while maintaining consumer protection. In a recent interview, Armstrong welcomed Trump’s pro-crypto plans, stating that they would create a more favorable environment for innovation, potentially bringing more institutional investors and mainstream adoption to the space.

Armstrong noted that Trump’s policies could pave the way for greater legitimacy of digital assets in the eyes of both regulators and the public. He emphasized that clearer regulations would make it easier for traditional financial institutions to enter the market and for crypto companies to scale in a way that aligns with existing financial regulations.

Implications for Crypto, Finance, and Tech

Trump’s endorsement of cryptocurrencies could signal a seismic shift in the regulatory landscape, with far-reaching implications for several industries:

- Crypto: The most immediate impact will likely be felt in the crypto industry itself. A more favorable regulatory environment would mean less uncertainty for startups, investors, and users. With greater legal clarity, digital assets could achieve broader institutional adoption, attracting capital from traditional investors who have previously been hesitant due to regulatory ambiguity. A surge in innovation could also lead to new projects, products, and services that cater to both retail and institutional customers.

- Finance: For the financial sector, Trump’s plans could introduce blockchain as a mainstream technology. If digital currencies like Bitcoin and stablecoins are more widely embraced as legitimate assets, traditional banks and financial institutions may need to integrate crypto services into their offerings, allowing customers to seamlessly engage with both fiat and digital assets. Additionally, central bank digital currencies (CBDCs) could become a topic of serious discussion as governments consider how to coexist with decentralized assets while ensuring monetary control.

- Tech: The technology sector could experience a boom as blockchain technologies gain acceptance. Companies operating in areas like decentralized finance (DeFi), smart contracts, and NFTs could see an increase in demand for their products, creating new business opportunities and driving tech innovation. As the infrastructure around crypto becomes more robust, it could lead to more widespread use of digital wallets, dApps (decentralized applications), and the development of next-gen digital services.

Challenges and Potential Roadblocks

While Armstrong and many in the crypto space are optimistic about Trump’s crypto push, challenges remain. The path toward comprehensive regulation is still fraught with political hurdles, and policymakers may struggle to balance innovation with consumer protection, security, and fraud prevention. Additionally, there are concerns that centralized control could stifle the decentralization ethos that many crypto advocates cherish.

Moreover, the long-term sustainability of Trump’s vision depends on bipartisan support in the U.S. Congress, which may be difficult to achieve given the polarized political landscape. The influence of traditional financial institutions and concerns about digital asset volatility could lead to regulatory pushback, even in the face of Trump’s advocacy.

The Bigger Picture: The Global Crypto Race

Trump’s pro-crypto rhetoric isn’t just reshaping the U.S. landscape—global competition is heating up as well. Other nations, particularly in Asia and Europe, are taking steps to either embrace or regulate digital currencies, creating a race for digital finance dominance. As Trump pushes for U.S. leadership in crypto, countries like China and Singapore have already established themselves as crypto-friendly havens.

If the U.S. successfully implements policies that nurture blockchain innovation, it could solidify its position as a leader in the global digital asset race. However, this will require careful collaboration between lawmakers,

What’s Next for Coinbase and the Crypto Ecosystem?

For Coinbase and other companies in the crypto industry, Trump’s crypto agenda could open the door to exciting new growth opportunities. However, industry leaders will need to remain vigilant as they navigate the evolving regulatory landscape. The crypto space must continue advocating for a regulatory framework that fosters growth while addressing concerns around fraud, security, and market manipulation.

As the U.S. looks to define its future in the crypto world, Coinbase and its CEO Brian Armstrong will play a pivotal role in shaping the direction of the market. With Trump’s plans putting digital assets at the forefront of national discourse, the coming months could be a defining period for the future of cryptocurrency.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News