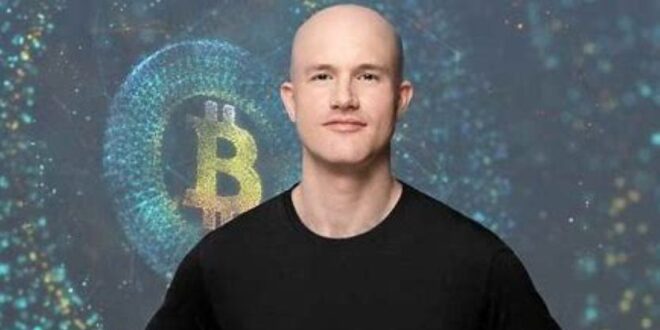

Coinbase CEO Brian Armstrong has thrown his support behind a bold new initiative aimed at establishing Bitcoin as a global strategic reserve asset. The move has sparked widespread discussions within the crypto community and financial sectors, with proponents hailing it as a step towards financial sovereignty and critics questioning its feasibility.

A Vision for a Decentralized Financial Future

Armstrong envisions a world where Bitcoin serves as a hedge against economic instability and inflation, much like gold has historically functioned. By advocating for a global Bitcoin reserve, he aims to position the cryptocurrency as a critical component of national and corporate treasury strategies.

“Bitcoin is the ultimate store of value in an increasingly uncertain world,” Armstrong stated in a recent interview. “Its decentralized nature and fixed supply make it an ideal reserve asset for governments and institutions alike.”

The Push for Adoption

The Global Bitcoin Strategic Reserves Initiative, as proposed by Armstrong, encourages governments, corporations, and financial institutions to allocate a portion of their reserves to Bitcoin. The initiative emphasizes the potential benefits of Bitcoin’s transparency, security, and resistance to censorship.

Major financial institutions are reportedly evaluating the proposal, and some have already begun to experiment with Bitcoin holdings. Countries facing currency devaluation or economic uncertainty may find the concept particularly appealing.

Challenges and Concerns

Despite Armstrong’s enthusiasm, the proposal faces significant hurdles. Regulatory uncertainty, Bitcoin’s price volatility, and concerns over environmental impacts related to mining continue to be major obstacles. Critics argue that relying on such a volatile asset could introduce risk rather than mitigate it.

“While Bitcoin offers unique advantages, its volatility and regulatory uncertainty make it a challenging reserve asset,” said economic analyst Sarah Greene. “Governments and corporations will need clear guidelines and risk management strategies before embracing it.”

Armstrong’s push for a global Bitcoin reserve comes at a time of increasing institutional adoption of cryptocurrency. With central banks exploring digital currencies and inflation concerns rising globally, Bitcoin’s role as a potential hedge is gaining traction.

If the initiative gains momentum, it could pave the way for broader acceptance of Bitcoin in mainstream financial systems and potentially redefine the way reserves are managed in the digital age.

The idea of Bitcoin as a global strategic reserve is ambitious, but it aligns with the broader trend of digital asset adoption. Whether it becomes a widespread reality or remains a niche strategy will depend on regulatory developments, market dynamics, and the willingness of key stakeholders to embrace the vision.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News