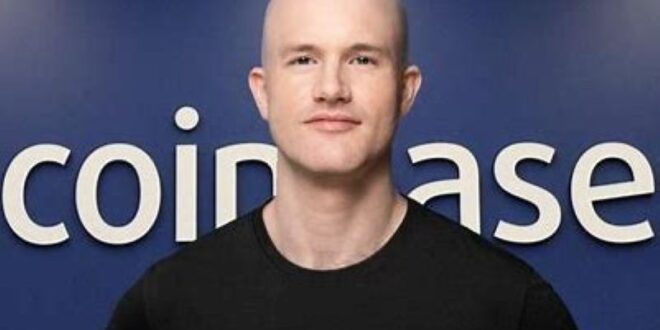

Brian Armstrong, the CEO of Coinbase, has publicly endorsed the Global Bitcoin Strategic Reserves Initiative (GBSRI), a movement aiming to establish Bitcoin as a key asset in global financial systems. This bold proposal could reshape the role of Bitcoin in the global economy, elevating it from a speculative asset to a cornerstone of national and institutional reserves.

What is the GBSRI?

The Global Bitcoin Strategic Reserves Initiative seeks to encourage governments, financial institutions, and multinational organizations to allocate a portion of their reserves to Bitcoin. Proponents argue that Bitcoin’s limited supply, decentralization, and deflationary properties make it a superior hedge against inflation and financial instability.

The initiative also aims to standardize Bitcoin’s use in reserves, promote transparency, and foster collaboration between public and private sectors to integrate digital assets into the global financial system.

Brian Armstrong’s Vision

In a blog post, Armstrong expressed his strong support for the initiative, describing Bitcoin as “digital gold” with the potential to provide financial sovereignty and stability in an increasingly volatile economic landscape. He highlighted key benefits of Bitcoin reserves:

- Inflation Hedge: Bitcoin’s fixed supply makes it resistant to inflationary pressures that erode the value of traditional fiat currencies.

- Global Accessibility: As a decentralized asset, Bitcoin is accessible to any country or institution, bypassing traditional financial gatekeepers.

- Technological Innovation: Encouraging Bitcoin adoption could drive advancements in blockchain and financial technology.

Potential Impact on Global Finance

If widely adopted, the GBSRI could significantly alter the dynamics of international finance:

- Diversification of Reserves: Central banks and institutions would have an alternative to traditional assets like gold and U.S. Treasury bonds.

- Stabilization of Bitcoin’s Price: Increased adoption by governments and institutions could reduce Bitcoin’s volatility over time.

- Geopolitical Shifts: Nations leading in Bitcoin adoption could gain a strategic advantage in the global financial system.

Challenges and Criticism

While Armstrong’s endorsement has galvanized crypto enthusiasts, critics have raised concerns about the initiative:

- Volatility: Bitcoin’s price fluctuations remain a significant barrier to its adoption as a reserve asset.

- Regulatory Uncertainty: Governments are divided on how to classify and regulate Bitcoin, complicating its use in official reserves.

- Adoption Hurdles: Convincing risk-averse central banks and institutions to embrace Bitcoin will require significant effort and education.

Coinbase’s Role in the Initiative

As the largest publicly traded cryptocurrency exchange in the U.S., Coinbase is uniquely positioned to influence the adoption of the GBSRI. Armstrong hinted at Coinbase’s plans to develop tools and services to facilitate institutional and governmental Bitcoin acquisitions, reinforcing the exchange’s commitment to driving mainstream adoption.

Industry Reactions

The crypto community has largely applauded Armstrong’s support of the initiative. Prominent figures like Michael Saylor of MicroStrategy and Jack Dorsey have echoed similar sentiments about Bitcoin’s role in global reserves. However, skeptics in traditional finance remain cautious, emphasizing the need for more robust infrastructure and regulatory clarity.

The success of the GBSRI will depend on overcoming significant challenges, including Bitcoin’s volatility, regulatory hurdles, and the hesitancy of traditional financial institutions. Nevertheless, Armstrong’s backing provides credibility and momentum to the initiative, potentially attracting more influential voices to the cause.

Brian Armstrong’s endorsement of the Global Bitcoin Strategic Reserves Initiative marks a pivotal moment in the push to integrate Bitcoin into the global financial system. While the road ahead is fraught with challenges, the potential rewards could transform Bitcoin’s role from a speculative investment to a cornerstone of financial stability and innovation.

As the initiative gains traction, all eyes will be on the first governments and institutions to adopt Bitcoin as a strategic reserve, setting the stage for a new era in global finance.

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News

Business Sandesh Indian Newspaper | Articles | Opinion Pieces | Research Studies | Findings & News | Sandesh News